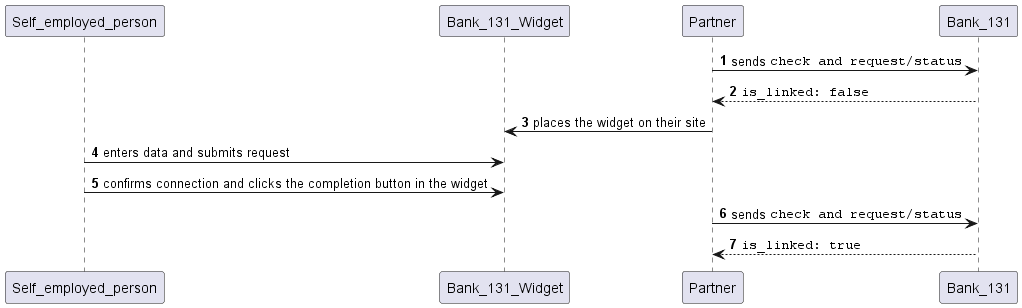

Connecting the self-employed to Bank 131

It is necessary to connect the self-employed person to Bank 131 to process payouts with fiscalization. This can be done using our special widget.

How to connect a self-employed person to Bank 131

-

You check the taxpayer status of the payout recipient and whether they are connected to Bank 131 using the

checkandrequest/statusmethods. -

Bank 131 replies that the individual with the provided INN value is registered as a self-employed person but is not connected to Bank 131.

-

You place our self-employed person connection widget on your website.

-

The self-employed person enters their INN or phone number, agrees to the personal data processing terms, and clicks the button to submit the request in the widget.

-

Bank 131 sends the Federal Tax Service a self-employed person connection request and notifies you that the self-employed person's confirmation is expected.

-

The self-employed person enters Moy Nalog (My Tax) and in the Partners section confirms the connection to Bank 131. After that, the self-employed person clicks the completion button in the widget.

-

Bank 131 sends a request to the Federal Tax Service to check the connection status and receives a reply confirming that the connection has been successful.

-

You check the connection to Bank 131 using the

checkandrequest/statusmethods once more to make sure the self-employed person is connected to Bank 131.

If the self-employed person confirmed the connection but did not click the completion button in the widget, Bank 131 will not be notified of the confirmation.

After the connection is completed, make sure the self-employed person's data available in the Federal Tax Service is up to date.

Self-employed person connection diagram