Payments with later capture

You can place a hold on the payment: first authorize or hold the amount of payment on the user’s card and then capture it with a separate request.

There is time between the funds being put on hold and the funds being debited so you can send the order to the customer, for example.

How it works

All in all, all payments made with the bank cards are done through the two phases. First — the authorization when the bank verifies if the needed amount is actually available and places a hold for this amount on the bank card, essentially blocking it. Second is the capture when the bank clears the payment and writes off the blocked or authorized amount from the bank card balance. It is possible to write off the full amount put on hold or a portion of it.

There is almost no time gap between the two phases when we are talking about the standard card payment flow, it looks immediate to the user.

However, if you decide to use the capture later payment flow, you can decide on the timing when to capture the blocked funds. In this case the bank will not capture the amount immediately, but will do so on your command.

How to enable later capture

Bank 131 manages the capture later feature. All your payments may have an immediate capture or the later one. If captured immediately, the amount of payment will be cleared automatically right after the authorization.

If you would like to perform payments with later capture, please contact your Bank 131 manager.

Hold period

The money is held for 5 days. If you do not debit or unblock it before the end of this period, the money will get unblocked automatically.

If you need the money to be debited rather than unblocked after the hold period end, please contact your Bank 131 manager.

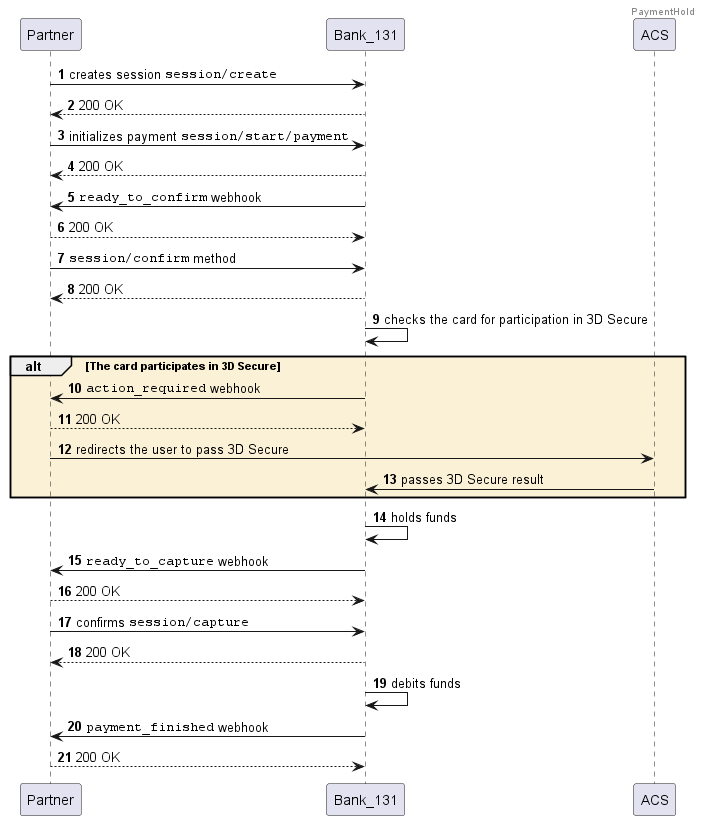

Later capture payment scenario

- You create a payment session that is separate from the actual payment (

session/create) or a single combined session (session/init/payment).

At this point, you can connect the payment form widget.

If you are not using the widget and have created the session separately from the start of the payment, you then need to send the

session/start/paymentrequest.Bank 131 then sends you the

ready_to_confirmwebhook, which means that the Bank is ready to perform the payout and is waiting for your confirmation.You confirm (

confirm_request) or cancel (cancel_request).If you are making a payment without a payment form, Bank 131 sends you the

action_requiredwebhook. This means that you will need to take additional action to perform the payment. For instance, the user might need to go through 3-D Secure.Redirect the user to the address for 3-D Secure.

Get webhook

ready_to_capturefrom Bank 131. It means there is a hold on the bank card funds that is placed successfully. It can be captured immediately or later. You can capture the full amount or a portion of it — see AmountDetails.Capture the full amount that is on hold, a portion of the amount (

session/capture), or decline the payment (cancel_request).Bank 131 sends you the

payment_finishedwebhook containing the result of the payment. If the status issucceeded, this tells you that the payment was successful.

Payment scheme with holding

This diagram shows a payment with holding, with a session starting separately from the payment, on a service with a PCI DSS certificate (without widgets).